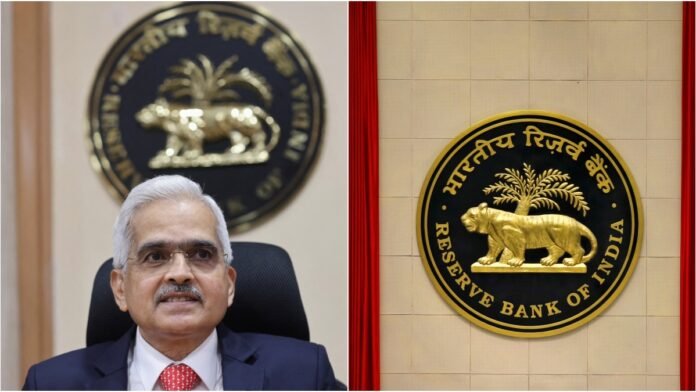

reserve Bank of India RBI Governor Shaktikanta Das said at the Monetary Policy Committee meeting this month that the country cannot afford another surge in inflation. He said the best approach at present would be to adopt a accommodative stance and wait for inflation to come sustainably in line with the central bank’s target. He said this while voting in favor of keeping the policy rate unchanged in the meeting held from October 7 to 9 this month. According to the minutes of the Monetary Policy Committee (MPC) meeting released on Wednesday, Das said, “Monetary policy can sustainably support economic growth only by maintaining stability at the price level.” prime interest rate

5 out of 6 members voted in favor

In the meeting, the MPC decided to maintain the key policy rate repo at 6.5 percent for the 10th consecutive time. Of the six members, five voted in favor of it while one voted in favor of reducing it. However, the committee unanimously decided to change its stance to neutral by withdrawing its earlier liberal stance. This was the first meeting of the MPC after its reconstitution. The three newly appointed external members are Ram Singh, Saugata Bhattacharya and Nagesh Kumar. According to the minutes of the meeting, Das said monetary policy can sustainably support economic growth only by maintaining price stability.

voted for neutral stance

“Taking all things into account, I vote to change the current stance to ‘neutral’ while keeping the policy rate repo unchanged at 6.5 per cent,” he said. Das said overall the Indian economy is stable and Presents a picture of strength. There is a balance between inflation and growth. Despite a near-term pick-up in inflation, headline inflation is expected to remain around the four per cent target at the end of the year and early next year, he said. “Overall, conditions are ripe for a shift from accommodative stance to a neutral monetary policy stance,” Das said. This will bring greater flexibility and options at the monetary policy level to act in accordance with the emerging outlook. It also provides scope to keep an eye on uncertainties with rising global tensions and fluctuations in commodity prices.”

Repo rate will not decrease soon

Echoing similar views, RBI Deputy Governor Michael Debabrata Patra had said that until inflation comes permanently close to the target, it would be appropriate to take a wait and evaluate approach with respect to the policy rate. They voted to maintain status quo on policy rates but move to neutral at the meeting. Another member, RBI Executive Director Rajiv Ranjan, had said that between now and December, things will become more clear on some of the uncertainties. These uncertainties include the US elections, risks globally and Chinese fiscal stimulus and global commodity prices.

Help is coming from the country’s strong growth story

Ranjan had said, “At this time, India’s strong growth story helps us continue to focus on inflation and keep the policy rate at 6.5 percent. Therefore, I am voting in favor of changing the status quo and stance on the policy rate to neutral.” External member Nagesh Kumar voted in favor of cutting the repo rate by 0.25 per cent. He had said that this is an opportune moment for the RBI to begin the process of normalizing monetary policy. The two other outside members of the reconstituted MPC, Saugata Bhattacharya and Ram Singh, also voted in favor of keeping the policy rate unchanged. However, he said that the stance will be changed to neutral.