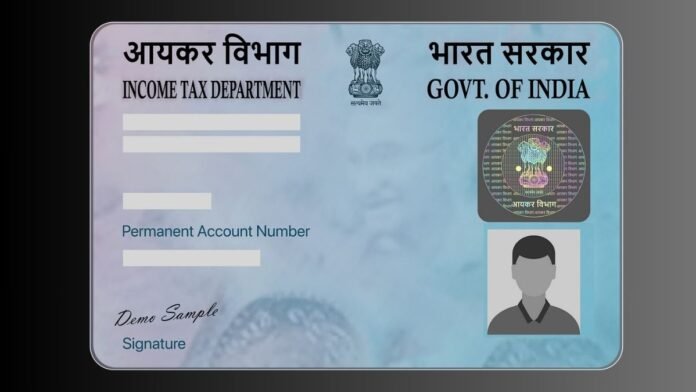

PAN 2.0 With the implementation of QR code based advanced system under the project, identification of fake cards will become easier and taxpayers will not be able to hold more than one PAN card. However, even after the introduction of the new system, the existing PAN cards will remain valid and the taxpayer will not need to apply for a new card. You will have to apply for PAN 2.0 card only if there is any change in the information related to the card. The Central Board of Direct Taxes (CBDT) on Tuesday clarified some very important things related to the PAN 2.0 project. CBDT has tried to answer the questions of the common people by issuing FAQs related to PAN 2.0. Let us tell you that the Union Cabinet under the leadership of Prime Minister Narendra Modi on Monday approved a project worth Rs 1,435 crore to issue a new type of QR based PAN card. This project, which will be implemented from next year, has been brought with the aim of making the existing system of issuing PAN advanced.

Income Tax Department issues PAN number

The PAN 2.0 project aims to create a ‘uniform business identifier’ for all digital systems of government agencies. PAN number is a unique 10 digit alphanumeric number issued by the Income Tax Department. This number is issued specifically to Indian taxpayers. According to the statement issued by CBDT, the objective of this project is to better manage and modernize the process of issuing and managing PAN and TAN. The project focuses on integration of multiple digital platforms and efficient services for PAN/TAN holders. Tax deduction and collection account number (TAN) will also be included in this project. At present around 78 crore PAN and 73.28 lakh TAN accounts exist. CBDT, the apex body of the Income Tax Department, said that PAN related services are available on three different platforms – e-filing portal, UTIITSL portal and Protege e-governance portal. But with the implementation of PAN 2.0, all these services will be available on a unified portal.

All work related to PAN will be done on one portal

With the help of the integrated portal, apart from requesting for PAN card application, correction and linking of Aadhaar with PAN, online verification of the card can also be done. CBDT has said that existing PAN holders will not need to apply for a new card. They will have to apply only in case they want to update their details. The PAN cards issued under the new system will be equipped with QR code through which the details entered in the card can be verified through digital medium. This will prevent fake applications and no person will be able to have more than one card. However, CBDT has clarified that the facility of QR code on PAN is not a new thing and it is present on the PAN card since 2017-18. But in the PAN 2.0 project, the QR code will be equipped with dynamic facility so that the latest data present in the PAN database can also be seen. These include information about photo, signature, name, parents’ names and date of birth.

Taxpayers will be able to apply for a new card

CBDT said, “Taxpayers holding old PAN cards without QR code will have the option to apply for a new card with QR code.” Along with this, it has been clarified in the FAQs that after the introduction of the new system. Also, the PAN held by individuals and businesses will remain valid and there will be no need to change it. However, to get a physical PAN card, the applicant will have to pay a fee of Rs 50. To safeguard the personal data recorded in PAN, it will be mandatory for all entities using this data to have ‘PAN Data Vault System’. Besides, the grievance redressal system under PAN 2.0 will also be strengthened.

With PTI inputs