Zomato, once hailed as the poster child of India’s startup ecosystem, has had a tumultuous journey since its IPO in 2021. After a prolonged period of lackluster performance, the company turned its fortunes around in June 2023, posting its first profitable quarter. This milestone sparked a remarkable rally, with the stock quadrupling investor wealth by December 2023. However, the euphoria seems to be fading as the stock has corrected by nearly 17% from its peak, raising questions about its future trajectory.

The Rise and Fall of Zomato’s Stock

From Dull to Dynamic

Zomato’s stock remained a lackluster performer for over two years post-IPO, struggling to gain traction amid mounting losses and investor skepticism. The tide turned in June 2023 when the company reported its first profitable quarter, driven by robust revenue growth and cost optimization. This breakthrough ignited a massive rally, with the stock surging over 300% in the next 18 months.

Recent Correction Sparks Concerns

However, the rally has lost steam in recent weeks. The stock has corrected by almost 17% from its peak, eroding 12% of investor wealth in less than a week. The sharp decline was exacerbated by brokerage firm Jefferies downgrading Zomato’s rating from ‘Buy’ to ‘Hold’ and slashing its price target from ₹335 to ₹275. This revised target implies a mere 10% upside from the current market price of around ₹250, dampening investor sentiment.

On January 8, Zomato shares were trading at ₹245.35 on the BSE, down 2.8% for the day, while the benchmark Sensex index fell by 0.56%.

Blinkit: The Hero and the Drag

Quick-Commerce Boom

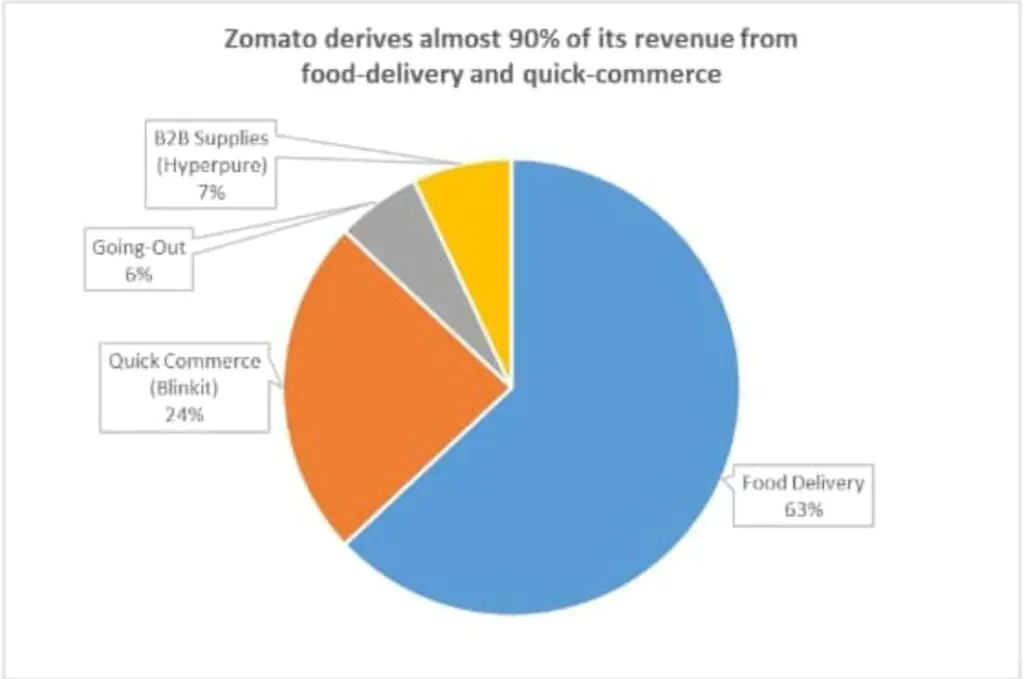

Zomato’s acquisition of Blinkit in 2022 marked its foray into the rapidly growing quick-commerce segment. Blinkit has emerged as a key revenue driver, contributing nearly 25% of Zomato’s total revenue in FY24 and even more in FY25. The segment has shown impressive growth, with gross order value (GOV) surging 122% year-on-year and average monthly transacting customers increasing by 89% in Q2 FY25.

Profitability Challenges

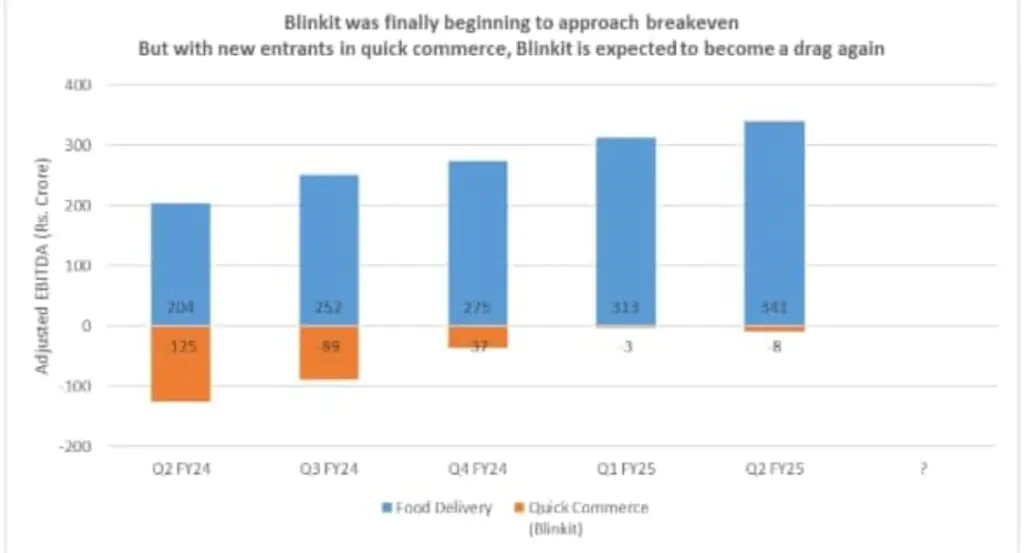

Despite its revenue contribution, Blinkit has been a drag on profitability. While Zomato’s core food-delivery business turned profitable in Q2 FY23, Blinkit’s losses delayed the company’s overall profitability until FY24. Although Blinkit achieved contribution positivity in Q2 FY24, it reported an EBITDA loss of ₹125 crore during the quarter, compared to the food-delivery business’s EBITDA profit of ₹204 crore.

Intensifying Competition

The quick-commerce segment is becoming increasingly competitive, with established players like Zepto and Swiggy’s Instamart facing new entrants such as Amazon’s Tez and Flipkart Minutes. To maintain its market share, Blinkit will need to ramp up investments in store and warehouse expansion, which could delay profitability for another two to three years.

Jefferies’ downgrade of Zomato’s stock was largely driven by its reduced earnings expectations for Blinkit, with the target multiple slashed by half to 6x. The brokerage also cut its EPS projections for Zomato in FY26 and FY27 by 20% each.

Food Delivery: The Cornerstone of Zomato’s Success

Strong Market Position

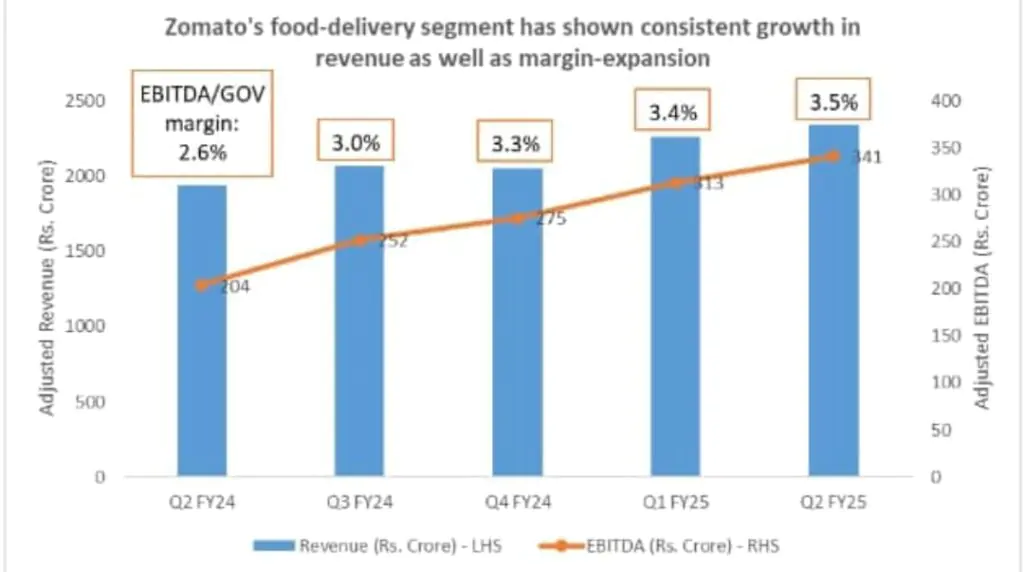

Zomato’s food-delivery business remains its backbone, accounting for the majority of its revenue and profits. As one of the first movers in India’s food-delivery market, Zomato has built a robust network of 250,000 restaurant partners and 400,000 delivery partners. This extensive network, coupled with advanced demand forecasting and fleet optimization models, has enabled Zomato to deliver consistent service at competitive rates.

Steady Growth Metrics

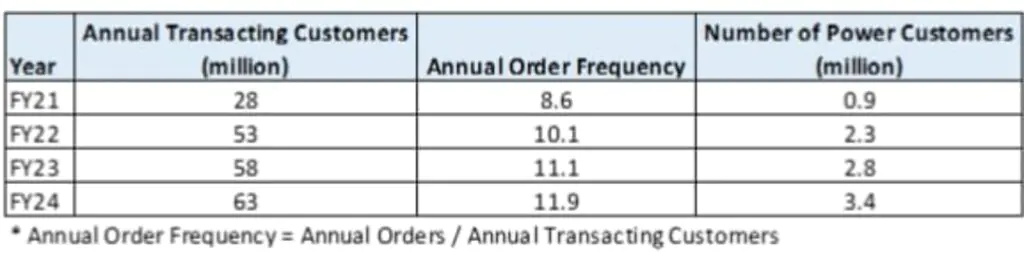

The food-delivery segment has shown steady growth, with gross order value (GOV) increasing from ₹7,980 crore in Q2 FY24 to ₹9,690 crore in Q2 FY25. The company has also seen a rise in annual transacting customers (ATC) and order frequency, with a growing number of “power customers” who place over 50 orders annually.

Long-Term Potential

With restaurant food penetration in India still relatively low, the food-delivery market offers significant growth potential. Zomato’s investments in restaurant and delivery partners position it well to capitalize on this opportunity, ensuring sustained profitability in the coming years.

Technical Analysis: A Bullish Trend Under Threat

Higher Highs and Higher Lows

Zomato’s stock has been in a clear uptrend since mid-2023, forming higher highs and higher lows. Key support levels have held firm during temporary corrections, with the ₹240 level acting as a strong support in September and November 2023.

Recent Correction Raises Red Flags

The current correction has brought the stock down to ₹250, close to the critical ₹240 support level. A sustained break below this level could signal the end of the uptrend, with the next support expected at ₹200. The recent decline has been accompanied by higher trading volumes, indicating strong selling pressure and increasing the risk of a trend reversal.

The Road Ahead: Balancing Growth and Profitability

Quick-Commerce Investments

While Blinkit’s growth has been impressive, its profitability remains elusive due to the need for aggressive infrastructure investments. The intensifying competition in the quick-commerce space will likely force Zomato to prioritize market share over profitability in the medium term.

Long-Term Prospects

Despite the near-term challenges, Zomato’s long-term prospects remain strong. The company’s dominant position in food delivery and its growing presence in quick-commerce position it well to capitalize on India’s evolving digital economy. This optimism is reflected in the fact that 23 out of 26 brokerages still maintain a ‘Buy’ rating on the stock.

FAQs

Why did Zomato’s stock correct recently?

The stock corrected due to profit-booking after a steep rally and a downgrade by Jefferies, which slashed its price target and earnings estimates.

What is Blinkit’s contribution to Zomato’s revenue?

Blinkit contributes nearly 25% of Zomato’s revenue but remains a drag on profitability due to high infrastructure costs.

How is Zomato’s food-delivery business performing?

The food-delivery business is growing steadily, with GOV increasing to ₹9,690 crore in Q2 FY25 and a rising number of transacting customers.

What are the key risks for Zomato?

Intensifying competition in quick-commerce and the need for heavy investments in Blinkit are the primary risks.

Is Zomato’s stock a good buy in 2025?

While the stock faces near-term challenges, its long-term prospects remain strong, with 23 out of 26 brokerages maintaining a ‘Buy’ rating.

Insights and Takeaways

Zomato’s journey from a loss-making startup to a profitable market leader is a testament to its resilience and adaptability. However, the recent correction highlights the challenges of balancing growth and profitability in a competitive market. While Blinkit’s drag on earnings is a concern, Zomato’s strong fundamentals and market position make it a compelling long-term investment.

What’s your take on Zomato’s future? Share your thoughts in the comments below and stay tuned for more updates on India’s dynamic startup ecosystem!